Introduction

The PayDock platform is designed to be as simple and easy to use as possible.

There are a few different ways to interact with PayDock:

- The API is a REST API, giving you full control

- Client SDK is a client side javascript library, which provides a secure way of collecting payment information and an easy way to access Paypal and saved payment sources

- Using one of our mobile SDKs, including Android and IOS

Getting started

You can get up and running using the PayDock API in just a few minutes.

Sign up for a sandbox account by contacting PayDock here. This will give you access to the admin portal.

If you do not already have services to connect, you can usually sign up for test accounts. You can see a list of some of the services we support here.

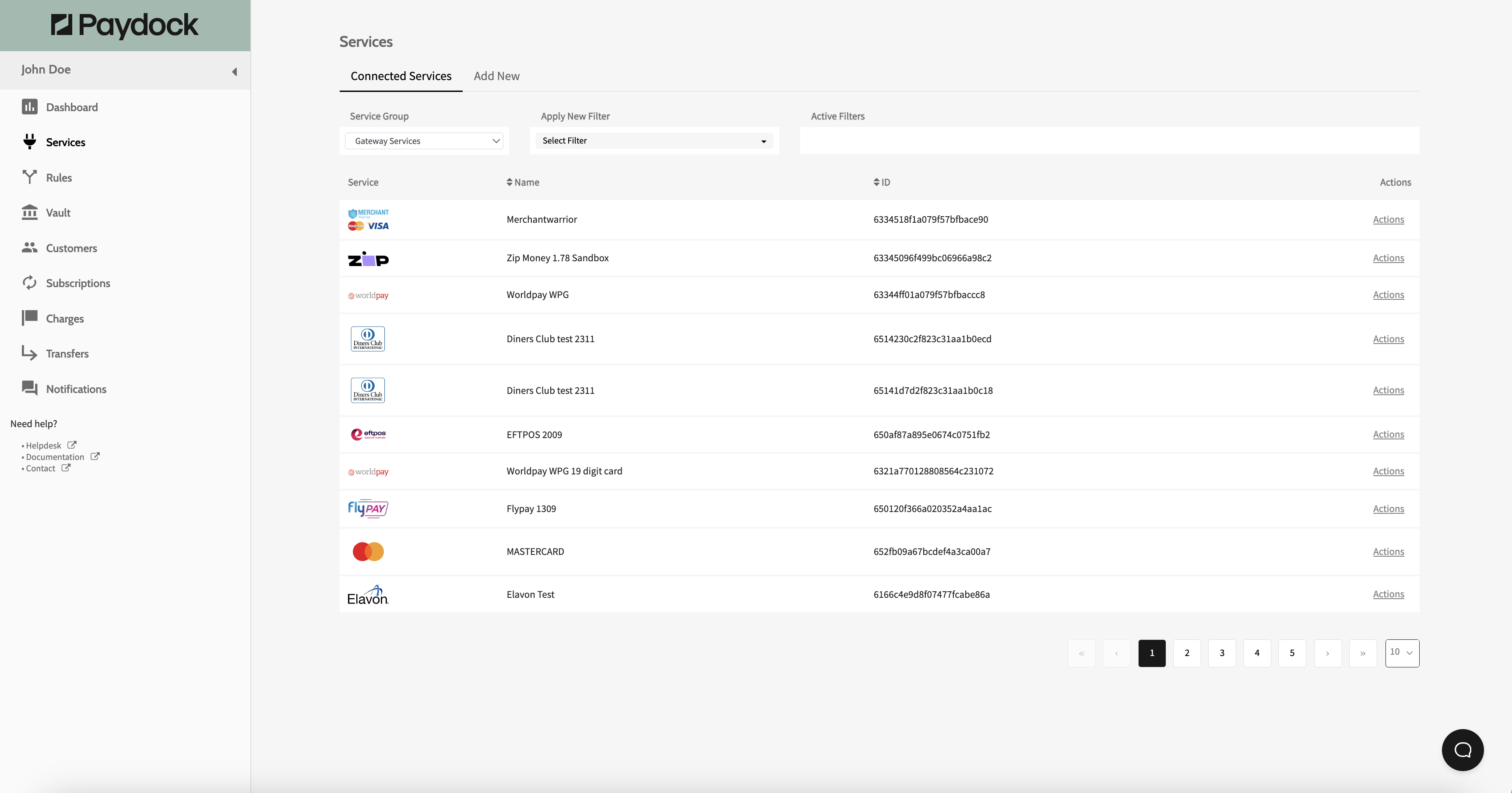

Then add a gateway in Gateway --> Add New:

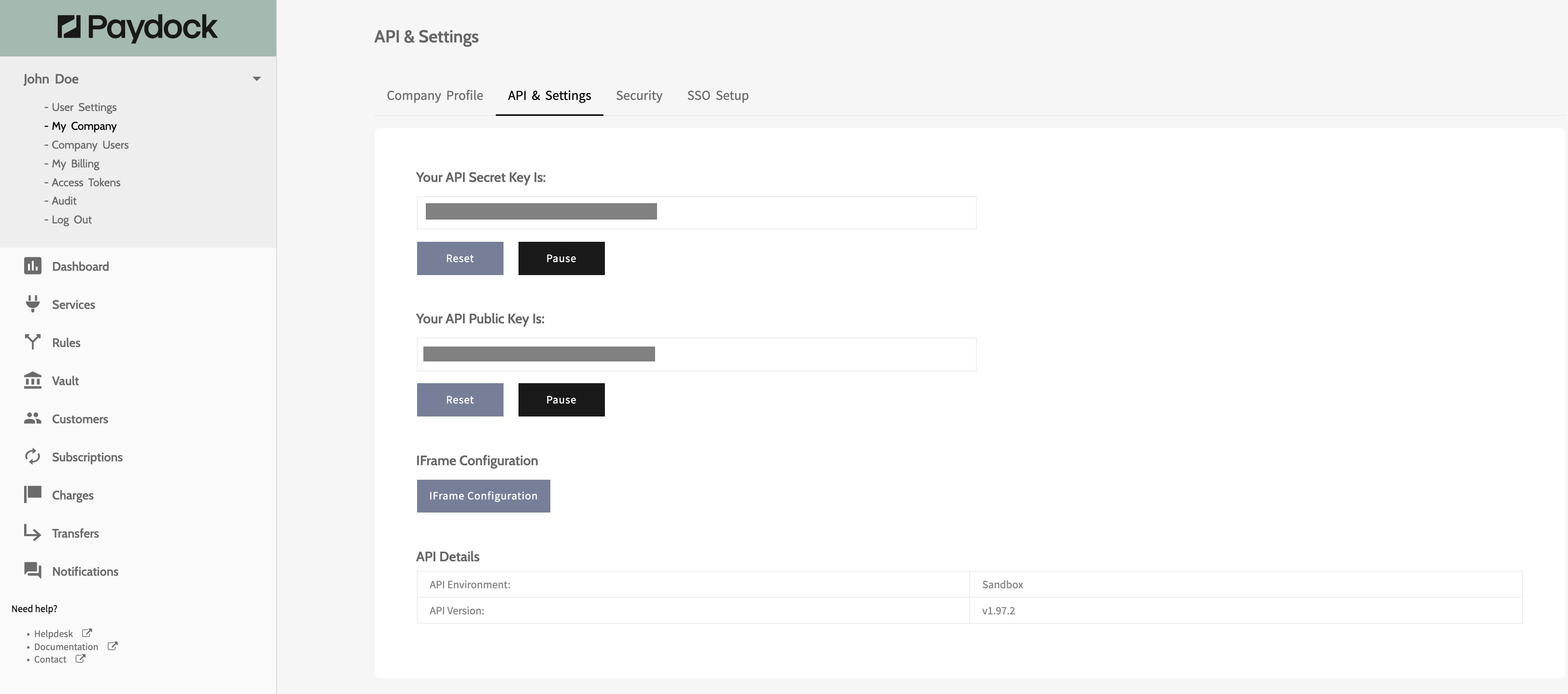

You can retrieve your API public and secret key from the admin portal in My Company --> API & Settings, which you'll need to authenticate:

Once done, jump into one of our Recipes:

Key Concepts

There are a few key concepts that help understand how to get the most out of PayDock's Platform

| Concept | Description |

|---|---|

| one-time token | This is a token that represents payment information. This is often generated on client (using Paydock.js or Client SDK). One time tokens expire after 3 hours. |

| payment source | A payment source represents a way of paying for something. This could be credit card details, bank account details or a PayPal account. There can be multiple payment sources associated with a customer. |

| gateway | A gateway is a payment gateway of any type that payments are routed to, eg Braintree, PayPal. |

| vault | The vault is PayDock's PCI compliant storage vault of payment sources. |

| vault token | A vault token is the reference code for a payment source, eg a credit card and expiry date |

| subscription | A subscription is a scheduled payment plan for a customer. |

| sandbox | A sandbox environment is a place where test API calls can be made without charging customers. |

| customer | An individual who can make payments. |

| admin portal | Web interface to manage your PayDock account |

Endpoints

An endpoint is a unique URL that represents an object or collection of objects which serves as the base of all PayDock API interactions.

PayDock provides two different public environments to access. You can access the different environments from the following URLS:

| Environment | API | Admin portal |

|---|---|---|

| Sandbox | https://api-sandbox.paydock.com | https://app-sandbox.paydock.com |

| Production | https://api.paydock.com | https://app.paydock.com |

To set up API calls, prepend all calls with:

Sandbox - https://api-sandbox.paydock.com

Production - https://api.paydock.com

Throughout the documentation URLs are provided relative to these base URLs.

eg

GET /v1/gateways for Sandbox, represents

GET https://api-sandbox.paydock.com/v1/gateways

eg

GET /v1/gateways for Production, represents

GET https://api.paydock.com/v1/gateways

Authentication

Authenticate with our API is provided by providing either your API Public Key or API Secret Key, depending on how you are using the PayDock platform. These are 40 character strings which you can find in out web app:

Authentication is managed slightly differently depending on how you're connecting to PayDock.

Connecting to the PayDock from the client side is managed through the Public Key or Access Token. Example:

- using Client-sdk

All other authentication is through the API Secret Key or Access Token. This is used to secure server side calls:

- using the API, the API Secret Key is added as a header

Response codes / Error codes

PayDock's API follows REST principles on status codes returned from our API.

In addition, the API will generally return a detailed error message and any downstream errors. See the right panel for examples

| HTTP code | Meaning | Description | Request type |

|---|---|---|---|

| 200 | Call successful | Appears on success request | any |

| 201 | Created successfully | Appears on success request while creating new resource | POST |

| 400 | Merchant data error | There is also an error code in response. Check the "error_summary" section for the details. | any |

| 403 | Permission denied | Authorization token does not have permission | any |

| 404 | Resource not found | The requested resource by id is not found for your visibility scope | any |

| 500 | System error | Unexpected server error | any |

| 408 | API unavailable | Only for .Net SDK. The response from the .Net SDK when it can't reach the API for some time | any |

In addition, the API will generally return a detailed error message and any downstream errors. See the right panel for examples

"Gateway processing error"

"error_summary": {

"message": "Transaction Declined",

"code": "transaction_declined",

"status_code": "05",

"status_code_description": "Do not honour",

"details": {

"gateway_specific_code": "DECLINED",

"gateway_specific_description": "The requested operation was not successful",

"messages": [

"Transaction Declined"

]

}

}

|

http code |

Cause |

Error Code |

Error Structure |

|---|---|---|---|

|

400 |

Internal validation |

|

{

message: string, code: string, details: { path?: string, messages: string[] } } |

|

400 |

gateway validation |

|

message: string, code: string, details: { path?: string, gateway_specific_code: string, gateway_specific_description: string messages: string[] } } |

|

400 |

gateway proccesing |

|

{

message: string,

code: string, status_code: string, status_code_description: string, details: { path?: string, gateway_specific_code: string, gateway_specific_description: string messages: string[] } } |

|

400 - 599 |

other |

|

{

message: string, code: string, details: { messages: string[] } } |

PayDock vault

"Example response with vault token"

{

"status": 201,

"error": null,

"resource": {

"type": "customer",

"data": {

"__v": 0,

"created_at": "2017-01-24T23:28:14.045Z",

"updated_at": "2017-01-24T23:28:14.045Z",

"status": "active",

"default_source": "5887e30d28e281756b883f64",

"reference": "Fuga consequuntur sint ab magnam",

"first_name": "Natalie",

"last_name": "Foster",

"email": "nwashington@gmail.com",

"_id": "5887e30c28e281756b883f63",

"payment_sources": [

{

"updated_at": "2017-01-24T23:28:14.045Z",

"vault_token": "dd634c0c-ea3b-4d82-b7fb-5ef2d2949ff6",

"gateway_id": "58377235377aea03343240cc",

"card_name": "Natalie Foster",

"expire_month": 1,

"expire_year": 2019,

"card_number_last4": "1111",

"card_scheme": "visa",

"ref_token": "53774915",

"status": "active",

"created_at": "2017-01-24T23:28:13.826Z",

"_id": "5887e30d28e281756b883f64",

"type": "card"

}

],

"statistics": {

"total_collected_amount": 0,

"successful_transactions": 0

},

"_service": {

"default_gateway_id": "58377235377aea03343240cc"

}

}

}

}

PayDock provides a PCI compliant vault for payment details. When the vault is enabled, all payment details are stored in the vault. The vault is enabled or disabled across a whole PayDock account, rather than for individual requests.

When the vault is enabled, any time a payment source is added, this information is stored in the vault. This most commonly happens when a payment source is added to a customer or a new customer is created. This is also visible in the response, which includes the id for the vault token, see example to the right (payment_sources -> vault_token).

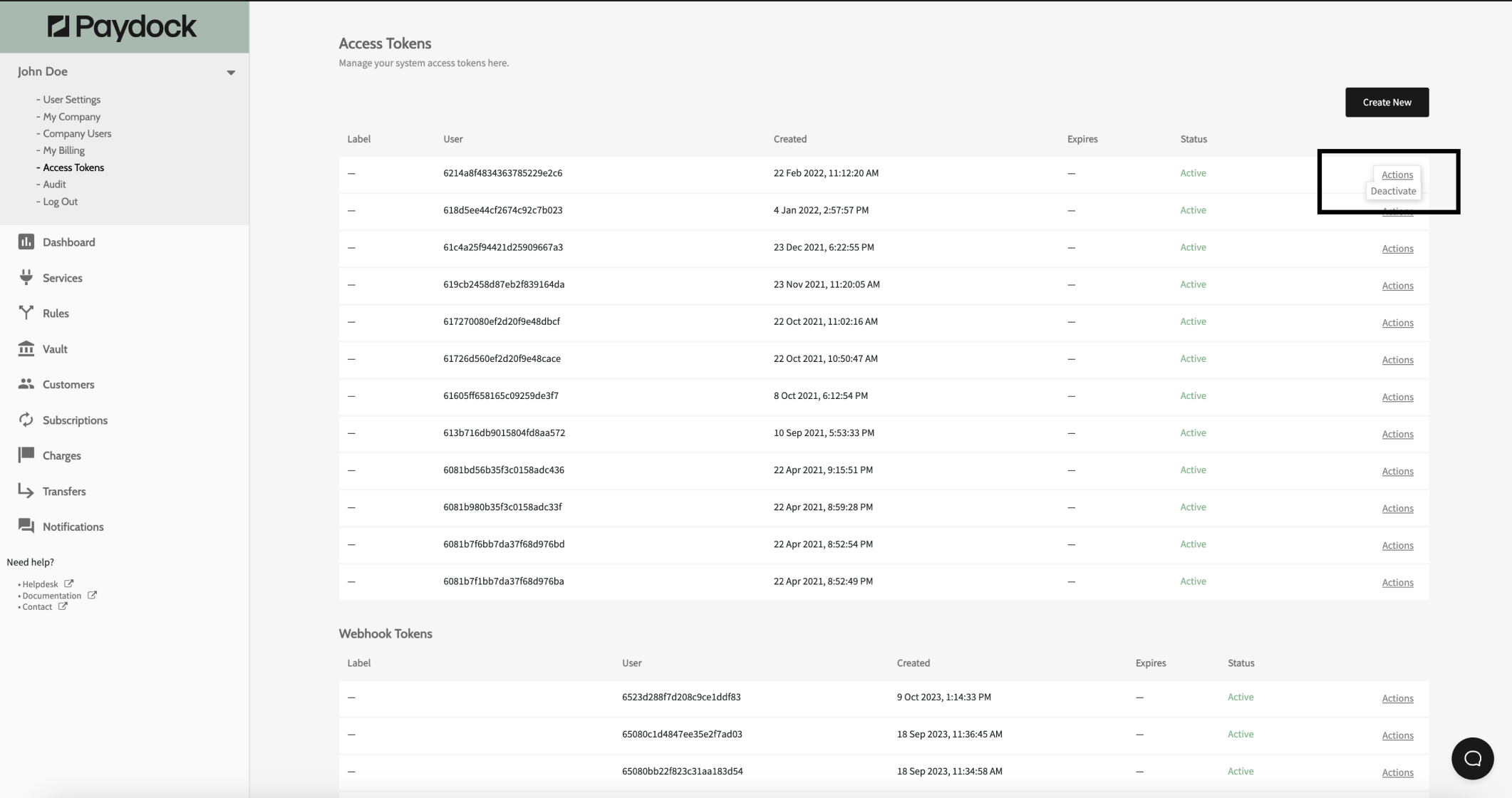

Access Tokens

Access tokens let you securely connect other systems or people to your PayDock account — without giving them your login details or full access.

You control exactly what each token can do, how long it lasts, and who can use it. Think of a token like a visitor pass: you decide what doors it opens and when it expires. You can generate an external access token in your PayDock dashboard if your role has the corresponding privileges. You can give only those permissions to this token which are enabled for your role.

Types of Access Tokens

There are two types of tokens, depending on where you are in the dashboard:

Brand-level tokens

- Created from the Brand scope

- Can access brand-level features only

- Only support API-based access (for server-to-server systems)

Merchant-level tokens

- Created from the Merchant scope

- Can access only that merchant

- Support both:

- API tokens (for backend systems)

- UI tokens (for browser-based tools and widgets)

Tokens created at one level cannot be used to access the other level.

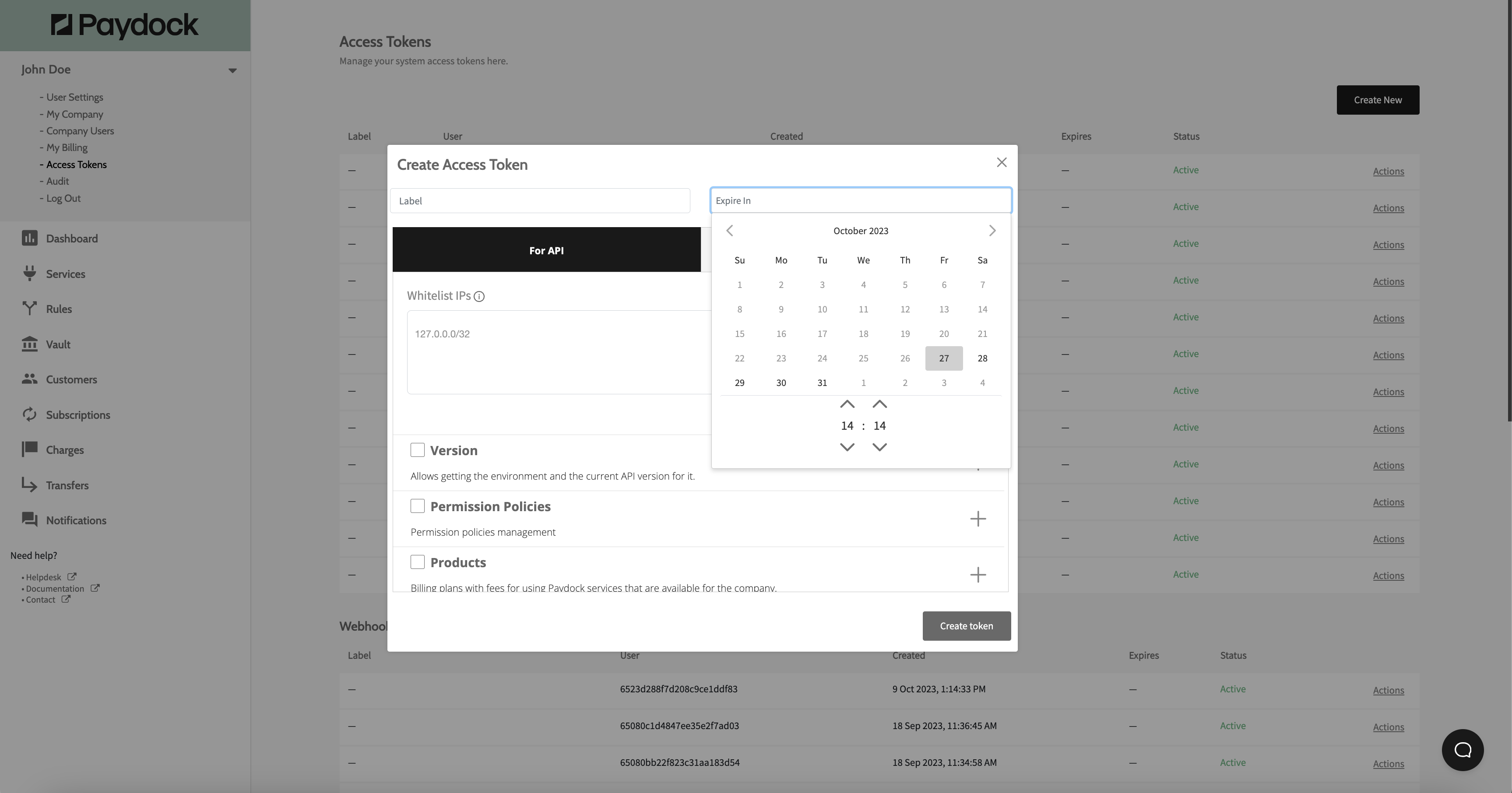

How to Create an Access Token

- Go to the Access Tokens section in your dashboard

- Click Create New

- Give the token a label (for example: "Reporting tool" or "Widget integration")

- Set how long it should last (e.g., 1 day, 7 days)

- Choose:

- API (for system integrations), or

- UI (for browser-based usage — available at merchant level only)

- API (for system integrations), or

- Limit access to specific IP addresses or domains (Optional)

- Select the exact permissions this token needs

- Click Create Token and copy it. The token value is only displayed once.

Why Permissions Matter

When you create an access token, you decide what it’s allowed to do (e.g., like view data, create payments, or update settings).

Giving a token more access than needed can lead to:

- Mistakes, like updating real data by accident

- Security risks if the token is lost or shared

- Unwanted changes to your account or merchant data

Always give the smallest amount of access needed. If someone only needs to look at payment history, don’t give them permission to create or delete anything. This is called the principle of least privilege.

Important: Widget tokens are publicly visible

If you are creating a UI token (for example, to use with a widget on your website), please note the following:

Widget tokens are public.

This means the token will be exposed in the browser and can be seen by anyone visiting the page, including other merchant users or potential attackers.

Because of this, it is very important that you:

- Only allow the specific permissions needed for the widget to work

- Do not give access to actions like viewing customer lists or managing charges

- Set an expiration time so the token is not valid forever

Example

If you’re using the token only to submit a payment form, the token should only have that permission and no other.

Giving a public-facing token broad access is one of the most common mistakes, and can lead to unauthorized actions if someone misuses it.

How to Use Tokens Safely

Remember: access tokens are like passwords and should be treated with care.

Best practices:

- Set an expiration time when creating the token and rotate them frequently

- Deactivate tokens when they’re no longer needed

- Never send a token in chat, email, or screenshot

- Only share tokens with people you trust

- Store tokens in a secure system (never in a Google Doc or text file)

- Don’t reuse the same token across multiple systems

If a token is lost or misused, go to your dashboard and deactivate it immediately.

How to Use a Token in an API Request

If someone is using the token to connect to your API, it must be added in the request header.

Correct:

x-access-token: YOUR_TOKEN

Request example

GET https://apista.paydock.com/v1/users/self

Headers: X-Access-Token: YOUR_TOKEN

Authorized response

{

"status": 200,

"error": null,

"resource": {

"type": "user",

"data": {

"_id": "YOUR_ID",

"email": "YOUR_EMAIL",

"first_name": "test",

"last_name": "test",

"created_at": "2020-04-10T10:48:20.746Z",

"updated_at": "2025-06-12T13:16:29.016Z",

"meta": {

"login_counter": 0,

"allowlist_ips": [],

"last_login_date": "2025-06-12T13:16:29.016Z"

}

}

}

}

Request example

GET https://apista.paydock.com/v1/users/self

Headers: none

Access forbidden response

{

"status": 403,

"error": {

"message": "Access forbidden",

"code": "token_required",

"details": {

"path": "",

"messages": []

}

},

"resource": {

"type": "key-management"

},

"error_summary": {

"message": "Access forbidden",

"code": "token_required",

"details": {

"messages": []

}

}

}

Incorrect:

- Don’t put the token in the URL

- Don’t send it in plain text or logs

Common Mistakes to Avoid

| Mistake | Why it's a problem |

|---|---|

| Giving full access to every token | Risk of misuse, especially if shared |

| Not setting an expiration | Tokens stay active forever if not revoked |

| Sharing tokens over email or chat | Easy to leak or lose control |

| Using the same token for everything | Hard to track who is doing what |

| Forgetting to disable unused tokens | Leaves an open door in your system |

Good Examples

| Use Case | Token Type | Scope | Expiration | Example Permissions |

|---|---|---|---|---|

| Person building reports | API | Brand | 7 days | View reports |

| Hosted checkout widget | UI | Merchant | 2 hours | Submit card, tokenize data |

| Temporary contractor | API | Merchant | 1 hour | View charges only |

Summary

- Create one token per use case

- Always review permissions before clicking "Create"

- Rotate tokens frequently

- Deactivate tokens you don’t use anymore

- If in doubt, ask your team or our support team

Access tokens give are a flexible tool that requires responsibility. Use them carefully. Protect your business.

Checkout Feature

This document will guide you on how to correctly integrate the Checkout feature via Paydock.

What is Checkout?

The Checkout feature revolutionises the merchant's checkout process by offering a user-friendly, adaptable, and easily customisable checkout solution. This innovative approach streamlines transactions and provides a seamless experience for both merchants and customers. Through available customisation options, merchants can align the checkout interface with their brand identity, making it appear native to their e-commerce ecosystem. This includes matching colour schemes and fonts to create a cohesive shopping experience from browsing to purchase completion.

Key Benefits

- Ease of deployment and maintenance: Deployment of new features/capabilities with minimal code, providing simple integration and easily add additional features into your existing ecommerce ecosystem.

- Reduced Complexity: Eliminates the need for merchants to understand and manage complex business flows and payment gateway specifics by providing a single Master Widget that requires one API call for initialization.

- Centralized Customisation: Allows for consistent styling and layout configurations across different platforms with minimal code changes.

- Enhanced Monitoring: Provides a comprehensive overview of the user's payment journey, facilitating better tracking and troubleshooting.

Core Functionalities

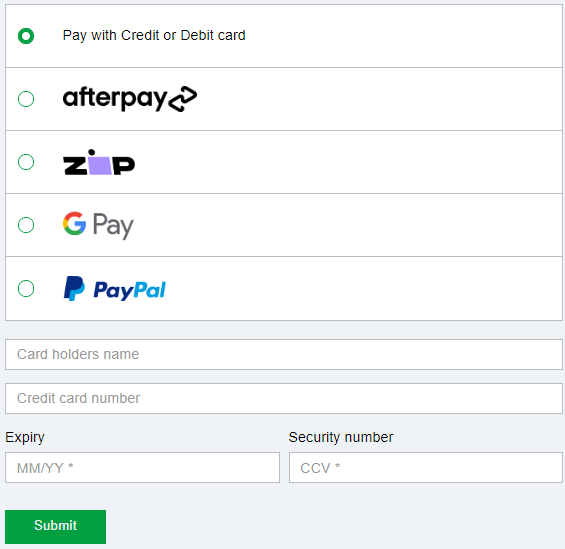

- Presents a wide array of payment methods to customers

- Integrates value-added services seamlessly

- Facilitates a smooth and secure transaction flow

| Current Supported Services and Flows | |

|---|---|

| Card Payments Flows: | Card Payments with 3D Secure (Recommended) Card Payments without 3D Secure |

| Wallet Based Payment Methods | Apple Pay Direct Charge Google Pay Direct Charge PayPal Direct Charge |

| Alternate Payment Methods: | Afterpay v1 Direct Charge Zip Direct Charge |

Before you begin:

How to Setup Checkout

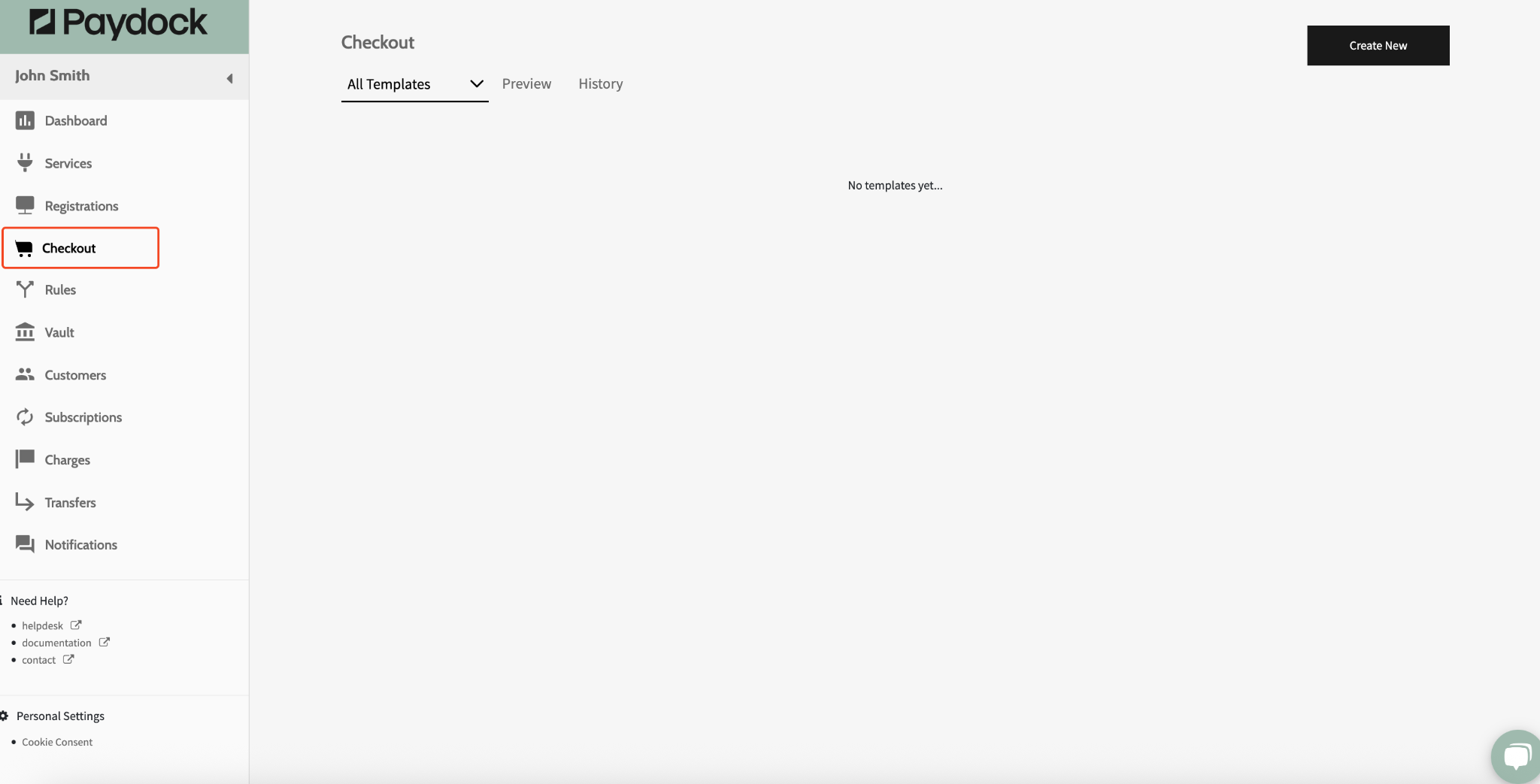

- Log into the Paydock Merchant Dashboard

- Navigate to 'Checkout' in the navigation section

- Select ' Create New'

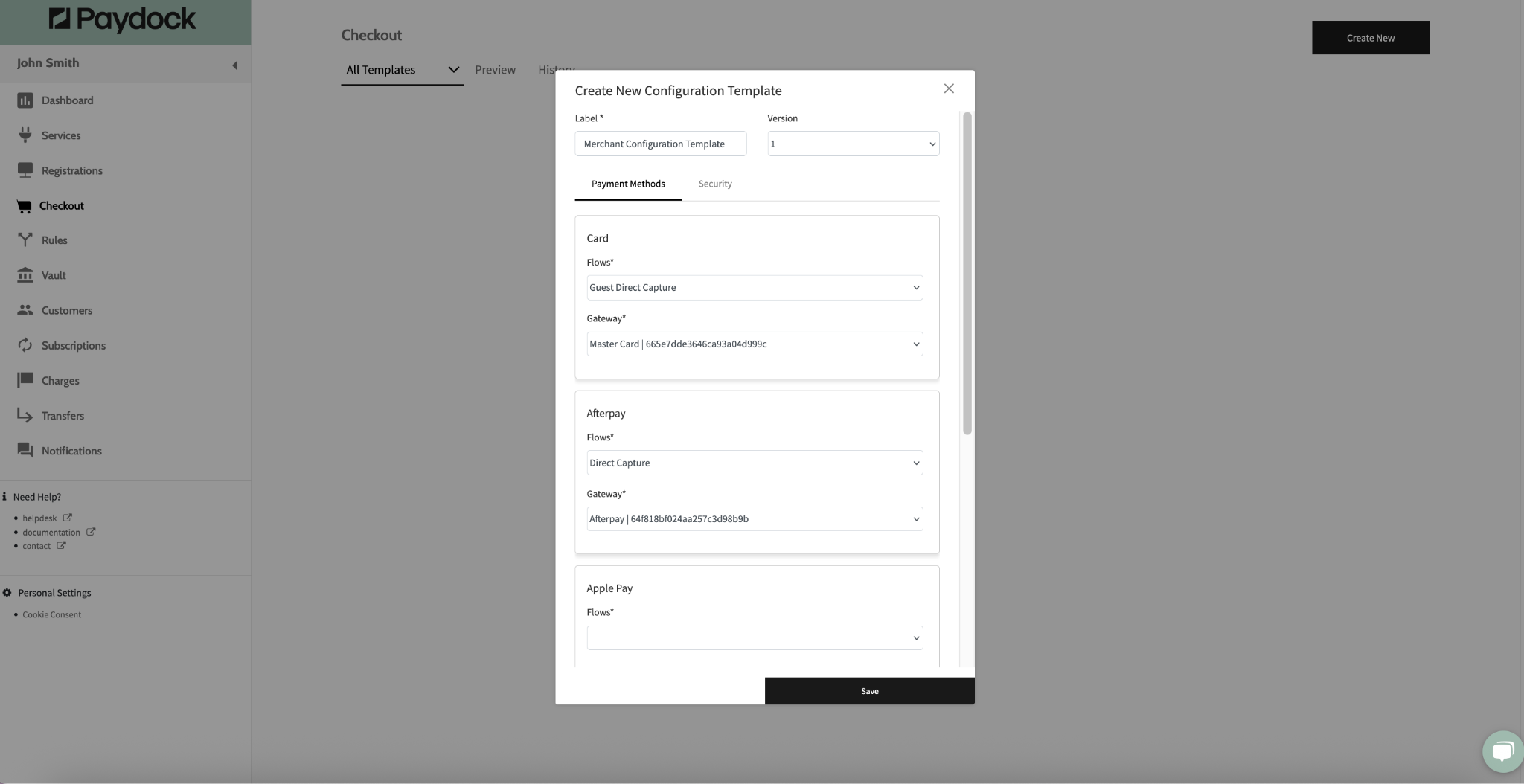

From the 'Select Template Options' you will get the choice of

- Customisation - (Template designed specifically for customising the look and feel of your checkout experience)

- Configuration - (Templated designed specifically for selecting what workflows/payment services will be included in your checkout experience)

- Configuration & Customisation - (Allows you to create the 2 above templates simultaneously)

Select the template that you wish, for a first-time setup, we recommend using the Configuration & Customisation option.

- Customisation - (Template designed specifically for customising the look and feel of your checkout experience)

On the next step, you will get the option to label your templates, we recommend that you keep these unique and call out if the template is for configuration or customisation. On configuration you will also get the option to select which version of the configuration template you want to create.

After selecting your API version this will bring up a list of services, for the service you wish to enable, select a transaction flow associated with the service you wish to enable and select the Service ID from the available dropdown. You can see a list of all your services in the 'Services' screen

Once you have selected your workflows and Service ID's associated with each service, click 'Save and Next' (You will also have the ability to update an existing configuration template once it has been created)

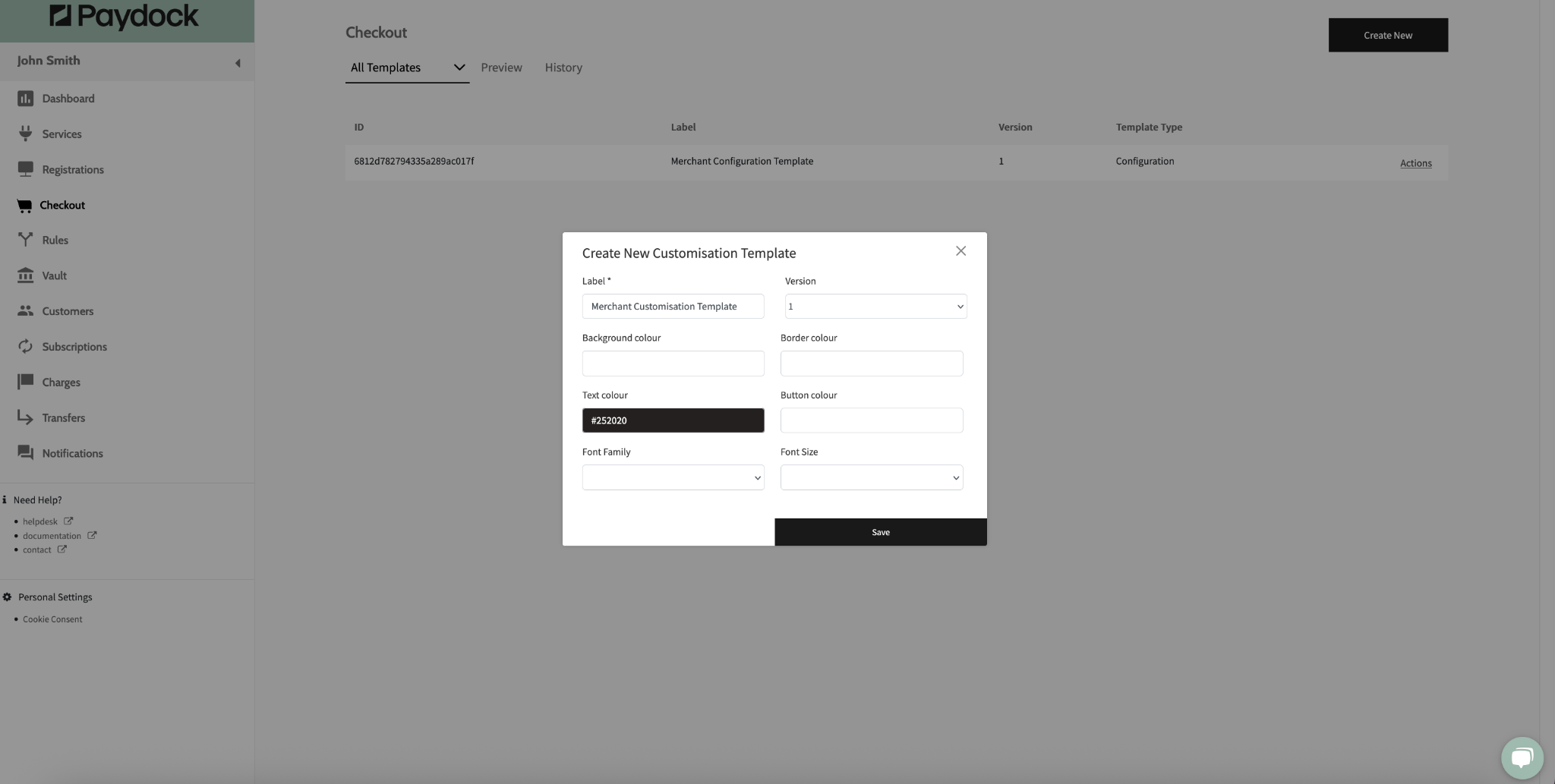

You will need to label your customisation template, similar to Step 5, we recommend you keep the label for your configuration template unique and identify that it is a Configuration Template.

You will have the ability to customise the look and feel of your Checkout Widget via the following fields:

- Background Colour

- Border Colour

- Text Colour

- Button Colour

- Font Family

- Font Size

- Background Colour

Apply your customization settings and click 'Save' (You will also have the ability to update an existing customisation template once it has been created)

You will now see the templates you just created appear in your Templates list with an associated ID which can be used in your integration.

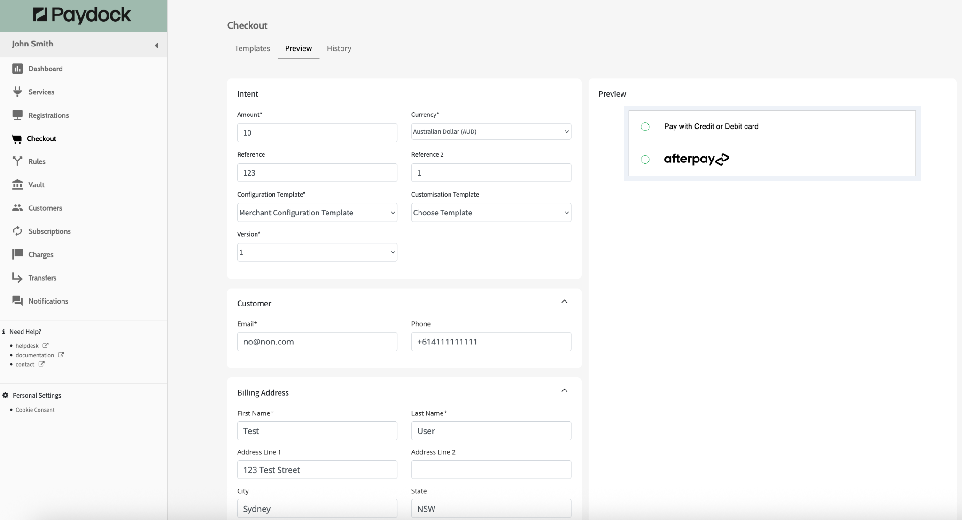

You will now see the templates you just created appear in your Templates list with an associated ID which can be used in your integration. If you wish to preview the templates that you have created, you can select the 'Preview' option on the Checkout page which will give you the ability to add some configuration data to render the widget within the Merchant Dashboard. (Note: Preview option is only currently available in the PreProduction environment)

Enter information into the provided fields and select the Configuration and Customisation templates you have just created. Once the information has been entered, hit 'Create' and this will render the widget into the 'Preview' column.

In the PreProduction environment the preview tab will allow you to run test transactions using your created templates you have created. For testing Card Payments, you can use our Paydock Test Cards

How to Integrate the Checkout Master Widget

Step 1) Create Configuration and Customisation Templates

Refer to the 'How to Setup Checkout' part of this guide to see how this can be done.

Step 2) Generate Intent Token via API

The Intent encapsulates the payment context for the transaction. It is recommended that you collect all fields within the intent token request as this will allow you to use all existing payment methods and future proof you for any additional payment methods that are added in the future.

| API Endpoint | <https://api.paydock.com/v1/checkouts/intent> |

|---|---|

| HTTP Method | POST |

| Headers | x-access-token- Paydock_ACCESS_TOKEN - This is your Paydock API Access Token. Content-Type - application/json - Type will always be application/json. |

| Request Parameters | customisation.template_id - string - Your previously created Customisation ID for the Checkout Widget configuration.template_id - string - Your previously created Configuration ID for the Checkout Widget customer.email - string - Customers Email Address customer.phone - string - Phone Number of Customer customer.billing_address.first_name - string - First Name of Customer. customer.billing_address.last_name - string - Last Name of Customer. customer.billing_address.address_line1 - string - Customer Address Line 1 customer.billing_address.address_line2 - string - Customer Address Line 2. customer.billing_address.address_city - string - Customers City. customer.billing_address.address_state - string - Customers State. customer.billing_address.address_country - string - Customers Country customer.billing_address.address_postcode - string - Customers Postcode amount - string - Total amount for the transaction. version - string - The version of Checkout API being used. currency - string. Always set to 'AUD' reference - string. A unique reference for the transaction |

Request Body:

JSON

{

"customisation": {

"template_id": "YOUR_CUSTOMISATION_TEMPLATE_ID"

},

"configuration": {

"template_id": "YOUR_CONFIGURATION_TEMPLATE_ID"

},

"customer": {

"email": "test@test.com",

"phone": "+6141111111",

"billing_address": {

"first_name": "Test",

"last_name": "User",

"address_line1": "123 Test Street",

"address_line2": "Unit 123",

"address_city": "Sydney",

"address_state": "NSW",

"address_country": "AU",

"address_postcode": "2000"

}

},

"amount": 120,

"version": 1,

"currency": "AUD",

"reference": "Order 12345678"

}

Response body:

JSON

{

"status": 201,

"error": null,

"resource": {

"type": "checkout",

"data": {

"_id": "67107db89d218493ecc4e082",

"version": 1,

"status": "active",

"reason": null,

"amount": 120,

"currency": "AUD",

"reference": "Order 12345678",

"journey": [

{

"sense": "info",

"title": "Workflow created",

"message": "Checkout process created ....",

"thread": "main",

"context": null,

"_id": "67107db89d218493ecc4e085",

"created_at": "2024-10-17T03:00:08.850Z",

"updatedAt": "2024-10-17T03:00:08.850Z"

}

],

"created_at": "2024-10-17T03:00:08.759Z",

"updated_at": "2024-10-17T03:00:08.850Z",

"token": "YOUR_INTENT_TOKEN"

}

}

}

Store the returned intent_token to utilise in the next step.

Note:'customisation.template_ID' and 'reference' fields are optional.

Step 3) Render the Widget using the intent_token

Use the returned intent_token from the previous step and use it to render the Checkout Widget to the end-user.

HTML

<div id="widget"></div>

<script

src="https://widget.paydock.com/sdk/latest/widget.umd.js"></script>

<script>

var widget = new cba.Checkout('#widget',"{{intent_token}}");

Step 4) Add event handling

The Master Widget in the checkout process sends specific notifications to merchants about their customers' checkout status. These notifications are crucial for managing the cardholder experience, addressing various checkout outcomes including:

onPaymentSuccessful

This event is triggered when a payment is completed successfully. It allows the merchant to

execute specific actions, such as updating the order status, notifying the customer of the

successful transaction, and/or redirecting the customer to a confirmation page

onPaymentError

This event is triggered when a payment fails. Merchants can use this event to handle payment

errors, such as displaying error messages to customers or logging the error details. When this event is returned, and the transaction has declined we recommend generating a new Intent Token and re-initialising the checkout widget to provide the end user with the ability to re-attempt their transaction.

onPaymentExpired

This event is triggered when a payment workflow session expires. This typically happens if the

customer takes too long to complete the payment (e.g after 15 minutes of inactivity).

Example below:

HTML

<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="UTF-8">

<title>Checkout</title>

<style></style>

</head>

<body>

<h1>Widget</h1>

<div id="widget"></div>

<script src="https://widget.paydock.com/sdk/latest/widget.umd.js"></script>

<script>

var widget = new paydock.Checkout('#widget', "{{intent_token}}");

widget.onPaymentSuccessful(function(data) {

console.log("success: ", data)

});

widget.onPaymentFailure(function(error) {

console.log("failure: ", error)

});

widget.onPaymentExpired(function(data) {

console.log("expired: ", data)

})

</script>

</body>

</html>

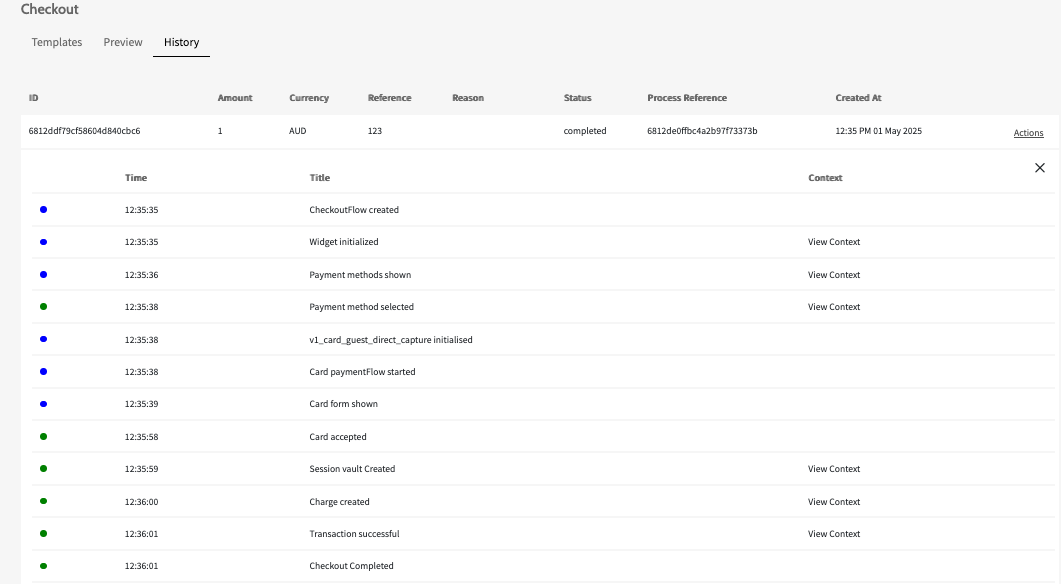

History

Paydock provides you with the ability to review the history of your users checkout experience by providing insights into the steps taken for your user to complete their checkout process. This includes:

- ID - Intent token ID

- Amount - As entered in the intent API request

- Currency - As entered in the intent API request

- Reference - As entered in the intent API request (optional)

- Reason - Additional information about the outcome of a given intent session

- Status - Status of a given intent session

- Process Reference - The ID of the charge generated through the Payment Workflow

process. - Created at - The time when the intent API request was successfully completed

Selecting Actions --> View logs will provide you with further insights to exactly what payment methods were selected and details around the outcome of these actions. These have been categorised into colour statuses, which are:

- Green = Success

- Blue = Informational action

- Orange = Warning

- Red = Error

Versioning

Versioning in Templates:

When a merchant creates Configuration or Customisation templates

in the Dashboard, they will see the 'Version' field. This field is important because it allows them

to manage and apply different versions of their templates across various checkout workflows.

- Version Transparency:

Each version of a template corresponds to a specific set of

features and behaviours. By specifying the version in the template, merchants can

ensure that the same configuration is applied consistently across all their checkouts.

- Backward Compatibility:

If the merchant updates a template to a new version, previous

versions remain supported. This means they can maintain older checkout workflows

without disruption while taking advantage of new features in updated versions.

Versioning in the Create Intent Endpoint:

When generating an intent using the /intent API

endpoint, merchants need to explicitly pass the version of the workflow that they want to use.

This is key to maintaining consistency between the API and the Master Widget.

- Explicit Versioning:

By specifying the workflow version in merchants' API request, they

ensure that the API and the Master Widget are aligned. This removes any ambiguity

about which version of the checkout process is being used, reducing the risk of

inconsistencies.

- Stability

During updates, even as Paydock releases updates to the API and Master

Widget, their integration remains stable. Merchants only move to a new version of the

workflow when they are ready, giving them control over the timing of any changes.

Network Tokenisation

Overview

Network Tokenisation is used in payment processing and protects sensitive card information. It does this by replacing actual card details (FPAN) with a unique identifier or token, which can be used to process payments without exposing the raw card information.

Supported Card Schemes

The following card schemes are supported:

- Mastercard via SCOF integration (phase 1)

- Visa via VTS integration (phase 1)

- Other schemes (tbc)

Supported Gateways

- MPGS (phase 1)

- Cybersource (phase 2)

Supported Value Added Services

- MPGS in-built 3ds (phase 1)

- Standalone 3ds Gpayments (phase 1)

Value Proposition

- Enhanced Security: Replaces sensitive card details with tokens, minimizing exposure of actual card information.

- End-to-End Encryption: Ensures data security throughout the transaction process, from the point of sale to the backend systems.

- Support for Various Payment Methods: Network tokenization supports different types of transactions, including e-commerce, in-store, and mobile payments.

- Scalability: As businesses grow, tokenization can easily scale to handle increasing transaction volumes without compromising security.

- Lower Fraud-related Costs: By mitigating fraud risks, merchants can save on costs associated with chargebacks, fraud investigations, and other related expenses.

- Increased Consumer Confidence: Enhanced security measures can increase customer trust in the merchant’s payment systems, leading to higher satisfaction and loyalty.

- Card Lifecycle Management: Automated issuer updates ensure that network tokens stored on file are kept up to date, reducing friction for end customers in subscription + returning customer stored on file use cases.

How to use the Network Token feature?

Configuration Guide

In the Paydock Merchant (Company) represents one legal entity. When configuring the company merchants can provide ABN as a business identification value. In the context of a Network, tokenisation functionality is recommended to have 1 Registration and 1 Service configured per Merchant account. The schemes (Visa and Mastercard) require Merchants to have 1 Registration (TRID) per legal entity. One TRID can’t be shared between multiple legal entities.

1. Network Token Registration

Before Network Tokens can be provisioned, merchants have to onboard/register with the Visa and/or Mastercard Network Tokenisation service (at the scheme-side). Going forward, the Network Tokens created and used by this merchant will be performed within the context of their registration (TRID). Network Tokens can’t be shared between Registrations (TRIDs). One registration should represent 1 legal entity based on scheme requirements.

**Note:* This operation is supported by both the API and the UI in Paydock.*

Create

Merchants are able to create Registrations via Paydock API and UI

- POST /v1/registrations - Create NT Registration.

- Fields that should be provided by merchant:

- “group”: network_token",

- "mode": "test" (or “live” or “virtual)”,

- "name": "Name of Registration in Paydock"

- "type": "MastercardSCOF" (or “VisaVTS)”,

- “merchant_data”: object

- “enable_vault_update”: false/true (If “Enable Vault Update” is true, then Vault Tokens linked to Network Tokens will be updated on Issuer Updates received from schemes)

- Merchant must have permission registrations:create

- Fields that should be provided by merchant:

Visa/VTS (API)

The following fields are relevant for the Visa/VTS registration request as part of merchant_data:

- Primary Legal Name (required)

- Website URL (required)

- City (required)

- Country (required)

- Acquirer Identifiers (required if Business Identification Value and Business Identification Type are not provided)

- Business Identification Value (required if Acquirer Identifiers are not provided)

- Business Identification Type (required if Acquirer Identifiers are not provided)

- Company Address line 1 (optional)

- Company Address line 2 (optional)

- Company State Province Code (optional)

- Company Postal Code (optional)

- Company Phone (optional)

- Dun and Bradstreet Number (optional)

- Company Trade Name (optional)

- Primary Contact First Name (optional)

- Primary Contact Last Name (optional)

- Primary Contact Email (required)

- Duns Number (optional)

Note: VTS registration in the production environment takes between 72 hours to a maximum of 5 calendar days. Before the onboarding is completed on the Visa side, merchants will not be able to provision or manage Network tokens

Mastercard/SCOF (API)

The following fields are relevant for the Mastercard/SCOF registration as part of merchant_data:

- Program Name (required)

- Acquirer Identifiers (ICA, BIN, Merchant ID) (optional)

- Primary Legal Name (optional)

- Logo URL (optional)

- Primary Website URL (optional)

- Display Name (optional)

- Merchant Category Codes (optional)

- Company Address Name (optional)

- Company Address line 1 (optional)

- Company Address line 2 (optional)

- Company Address line 3 (optional)

- Company City (optional)

- Company State (optional)

- Company Postal Code (optional)

- Company Country (optional)

- Debit Token Requested (optional)

Note: It takes 3+ hours for Mastercard/SCOF registration to be created.

After registration is successfully created, the status of registration will be changed to “completed”. Only at this point can subsequent steps be completed.

For more information on the Registrations API, please see the associated Postman documentation. registrations -> create

Update

Merchants are able to update Registrations via Paydock API and UI

Visa VTS

Visa doesn’t support registration update on the scheme side, so ONLY Paydock fields can be changed for Visa Registration. Paydock doesn’t support Visa Registration Update via UI, however, it’s available from API.

- PUT /v1/registrations/{id} - Update NT Registration.

- Merchants have to provide ONLY the fields they want to change in the Update NT Registration Request

- Merchant must have permission registrations:modify

- Merchants have to provide ONLY the fields they want to change in the Update NT Registration Request

Mastercard SCOF

Mastercard supports registration update on the scheme side, but ONLY a limited number of fields can be changed for Mastercard Registration. Please refer to Postman documentation to get information on which fields can be updated. Paydock support Mastercard SCOF Registration update for both UI and API.

- PUT /v1/registrations/{id} - Update NT Registration.

- Merchants have to provide ONLY the fields they want to change in the Update NT Registration Request

- Merchant must have permission registrations:modify

- Merchants have to provide ONLY the fields they want to change in the Update NT Registration Request

For more information on the Registrations API, please see the associated Postman documentation. registrations -> update

Read

Merchants are able to get and search Registrations via Paydock API.

- GET /v1/registrations - Search Registrations. This endpoint allows merchants to search registrations

- Merchant must have permission registrations:search

- Merchant must have permission registrations:search

- GET /v1/registrations/{id} - Get Registration by ID. This endpoint allows merchants to get Registration by ID

- Merchant must have permission registrations:get

For more information on the Registrations API, please see the associated Postman documentation. registrations -> get, search

Delete

Merchants are able to delete Registrations via Paydock API and UI

- DELETE /v1/registrations/{id} - Archives Registration on a Paydock side without deleting on the scheme side

- Merchant must have permission registrations:delete

For more information on the Registrations API, please see the associated Postman documentation. registrations -> delete

Revoke

Merchants are able to revoke Registrations via Paydock API and UI

- DELETE /v1/registrations/{id}/revoke - Archives Registration on a Paydock side and the scheme side

- Merchant must have permission registrations:revoke

Revoke operation is supported only for Mastercard via UI and API. Visa doesn’t support Revoke API. To Revoke Visa Registration, please reach out to the support team

For more information on the Registrations API, please see the associated Postman documentation. registrations -> revoke

2. Network Token Service Connectivity

The intent of the Service connectivity in Paydock, is to create the service_id that will be used for the API requests made

API Service Connectivity

After completing the registration process, the Network Token Service (NTS) needs to be configured to start creating network tokens. This involves connecting the appropriate NTS and setting it as the default=true for each card scheme.

Key points:

- For Visa cards only: Configure Visa NTS as default=true

- For Mastercard only: Configure Mastercard NTS as default=true

- For both: Configure both services as default=true

Important Notes:

- Services can only be connected to registrations with "completed" status

- Paydock recommends creating only one service per scheme per registration as scheme will return the same Network Token for multiple services. To optimize your setup and avoid redundancy, configure only the necessary services for your specific card scheme requirements.

- If NTS is configured, but not set up as default=true Network Tokens will not be created under Vault API. This enables flexibility for merchants to easily turn on/off Network Token creation.

Visa/VTS

Create service endpoint: POST {{url}}/v1/services

The following fields are relevant for the VisaVTS service connection:

- Service Name (required)

- Group (must be set to network_token)

- Type (must be set to VisaVTS)

- Mode (test or live)

- Registration ID

- Network Token Options with Default=true/false

For more information on the Visa/VTS service connection API, please see the associated postman API collection under: services -> create

Mastercard/SCOF

Create service endpoint: POST {{url}}/v1/services

The following fields are relevant for the Visa/VTS service connection:

- Service Name (required)

- Group (must be set to network_token)

- Type (must be set to MastercardSCOF)

- Mode (test or live)

- Registration ID

- Network Token Options with Default=true/false

For more information on the MastercardSCOF service connection API, please see the associated postman API collection under: services -> create

UI Service Connectivity (Phase 2)

Mastercard/SCOF and Visa/VTS

- Log into your company level account

- Navigate to Services from the menu on the left

- Click on the Add New tab from the top of the page

- Select the Network token group from the Service Group drop-down list

- Navigate to or search Network Token service (Visa or Mastercard) and click on the Activate button

- Complete the fields below to enable the Network Token service.

- Label – This is for your reference only

- Select existing Network Token Registration from the Registrations dropdown.

- Based on the selected Network Token registration, the following details will be auto-populated (as they are derived from the Network Token registration)

- Registration ID

- Group

- Type

- Environment

- Set flag “Set as Default“ = true if you want Network Tokens be created under the hood of the Vault API.

Note: If no service is “Set as Default“ = “true”. Network Tokens can’t be created. To support Network Tokens for Mastercard and Visa both services should be connected with “Set as Default“ = true. - Click Connect to complete the Network Token service connection.

- Label – This is for your reference only

3. Network Tokens Management

After service is connected Network Tokens can be created either automatically (under the Vault API) or with new endpoints for existing Vaults. Merchants are able to create network tokens via Paydock API.

Note: This is pre-requirements to start using Network Tokens for payments processing. Network Tokens only supported for Vault type “permanent“. Merchants must request and receive cardholder consent to “store card” before provisioning network tokens, as creating network tokens without cardholder consent is non-compliant.

For VISA: Network Tokens can't be created for Visa vaults without an email. If the email field is not provided by the merchant in the Vault creation request, Paydock will automatically generate it. It’s highly recommended for merchants to provide email and fall back to use Paydock’s generation in rare cases. Based on Visa feedback, there is no implication of using Paydock-generated emails, as it will not impact the success rate of the provisioning requests or transaction processing.

Create

- POST /v1/vault/payment_sources - Create Vault. Network Tokens will be automatically created under the hood of Vault API if the following requirements are met otherwise ONLY Vault will be created:

- Merchant has active Network Token service connected for relevant scheme with “default“ configured to “true“ and Registration connected to the service is in status “Completed“

- Merchant has permission vault-tokens:create

- Merchant has active Network Token service connected for relevant scheme with “default“ configured to “true“ and Registration connected to the service is in status “Completed“

- POST /v1/vault/payment_sources/{id}/network-tokens - Create Network Token. This endpoint allows merchants to create a Network Token for an existing Vault

- Merchant has active Network Token service connected for relevant scheme with “default“ configured to “true“ and Registration connected to the service is in status “Completed“

- Merchant has permission vault-network-tokens:create

- Merchant has active Network Token service connected for relevant scheme with “default“ configured to “true“ and Registration connected to the service is in status “Completed“

For more information on the Network Token API, please see the associated postman API collection under: network-tokens -> create

**Note:* For merchants requiring Network Token provisioning across multiple Vaults simultaneously, Paydock offers a streamlined solution Bulk Processing which allows to Provision Network Tokens for up to 100 Vaults in a single request*

How to Request:

- Contact Paydock support with your bulk provisioning needs

- Provide the necessary details for each Vault (up to 100)

- Our team will process the request and provision Network Tokens across specified Vaults

Read

Merchants are able to get and search network tokens via Paydock API.

- GET /v1/vault-tokens/{id} - Get Vault by Id. This endpoint allows merchants to get a Vault with Network Tokens

- Merchant has permission payment-sources-vault:get

- Merchant has permission payment-sources-vault:get

- GET /v1/vault/payment_sources - Search Vaults. This endpoint allows merchants to search Vaults with Network Tokens created in Paydock

- Merchant must have permission payment-sources-vault:search

- Merchant must have permission payment-sources-vault:search

- GET /v1/vault-tokens/{vault_token}/network-tokens/{id} - Get Network Token by Id. This endpoint allows merchants to get a Network Token by Paydock Id

- Merchant must have permission vault-network-tokens:get

For more information on the Network Token API, please see associated postman API collection under: network-tokens -> get, search

Update

Merchants are able to change “default“ network token for payments processing, this is relevant where a single vault_token has multiple Network Tokens underneath it. In this case, one of the child Network Tokens must be set as the ‘default’.

- PUT /v1/vault-tokens/{vault_token}/network-tokens/{id} - Update network token. This endpoint allows merchants to change “default“ network token for payments processing

- Merchant has permission vault-network-tokens:modify

For more information on the Network Token API, please see the associated postman API collection under: network-tokens -> modify

Delete

Merchants are able to delete network tokens from Paydock and scheme via Paydock API.

- DELETE /v1/vault/payment_sources/{id} - Delete Vault by Id. This endpoint allows merchants to delete Vault and Network Tokens by Vault Id

- Merchant has permission payment-sources-vault:delete

- Merchant has permission payment-sources-vault:delete

- DELETE /v1/vault-tokens/{vault_token}/network-tokens/{id} - Delete Network Token by Id. This endpoint allows merchants to delete Network Token by Id.

- Merchant must have permission vault-network-tokens:delete

**Note:* If Network Token with “default“ = true was deleted and Vault doesn’t have any default Network Token charges will be processed using raw card data*

For more information on the Network Token API, please see the associated postman API collection under: network-tokens -> delete

Network Tokens Failover

During the initial Vault creation, if a network token creation fails, our system automatically assesses the nature of the error. Errors are classified as either:

- Hard errors: These are non-retryable issues (such as a card being ineligible for tokenisation)

- Soft errors: These are temporary issues that can be resolved with retried attempts, such as temporary unavailability of the card network

For soft errors, our system employs an automatic retry mechanism. It will attempt to create the network token again at the following intervals: 1 hour, 12 hours, 24 hours.

This process ensures that up to three reattempts to create the network token are performed, maximizing the chances of successful tokenisation.

If the third and final reattempt fails, the merchant can reach out to support@paydock.com if further investigation is required (noting, this should be a rare case and the merchant should explore the available logs prior to reaching out to Paydock team).

4. Charge Creation with Network Tokens

There are no changes in endpoints and request bodies for the existing /charges and /subscriptions endpoints. These endpoints were extended to introduce compatibility with Network Tokens.

Charges flow that support Network Tokens:

- Charge creation with Vault

- Charge creation with Customer with Vault

Note: If the payment source is Vault token and Vault has a default Network Token and Registration to be used in status “Completed“, the charge will be made using Network Token instead of card data.

Subscriptions flows

- Subscription creation with Customer with Vault

- New subscription: A new subscription can be created with the Customer with Vault payment source. If Vault has default=true active Network Token and Registration to be used in status “Completed“, the charges will be made using Network Token instead of card data.

- Existing subscription: An existing subscription can be switched to use Network Tokens when:

- A subscription is created with the Customer with Vault payment source and then an active Network Token is created for this Vault with default=true. In this case, all subsequent charges under this subscription will be made using Network Token instead of card data if Registration is in the status “Completed“.

- A subscription is created with the Customer with Vault payment source and then the Default Customer Payment Source for this subscription is changed to Vault with an active Network Token with default=true. In this case, all subsequent charges under this subscription will be made using Network Token instead of card data if Registration is to be used in the status “Completed“.

- New subscription: A new subscription can be created with the Customer with Vault payment source. If Vault has default=true active Network Token and Registration to be used in status “Completed“, the charges will be made using Network Token instead of card data.

As stated earlier in this document:

- MPGS in-built 3ds will be available in Phase 1

- Standalone 3ds Gpayments will be available in Phase 1

On Fly Network Token creation

If a permanent Vault token does not have any Network Token already created under it, then the system will attempt to provision a Network Token if all of the following conditions are met:

- The gateway used for the charge supports Network Tokens

- Network Token Service is connected for the relevant scheme and “Set as default” = true

- Registration connected to the Network token service is in status Completed

On Fly Network token creation is supported for:

- Charges

- Subscriptions

- Verify

Issuer Updates

Network Token Issuer Updates

Network Token Issuer Updates enables merchants to keep Network Tokens up-to-date when Network Token's underlying information changes.

Scenarios when Network Tokens will be updated by Paydock:

- Network Tokens will be updated when:

- Network Token expiry date changes

- Network Token status changes (e.g. from Active to Suspended)

- Network Token expiry date changes

Vault (Card Details) Issuer Updates

Merchants can configure Vault updates to keep Vault Tokens up-to-date when underlying Card Information changes and Paydock receives notification from card schemes.

**Note:* Only Vaults with active Network Tokens are supported for this functionality. Vault updates cannot be performed if the Vault does not have an associated Network Token.*

Enable Vault Update is available as a configuration at the Registration level. By default, “Enable Vault Update” is turned off, and merchants need to explicitly “turn it on” by checking the checkbox or passing a parameter on the API level.

- If “Enable Vault Update” is turned on, then Vault Tokens linked to Network Tokens will be updated on Issuer Updates received from schemes.

- Vault Tokens and Customer Payment sources will be updated on card expiry date change

- Vault Tokens will be archived when the card is no longer active.

- Customer Payment Sources will NOT be archived. Merchants would need to explicitly update Payment sources linked to Vault and replace them with a new one

- Vault Tokens and Customer Payment sources will be updated on card expiry date change

- If “Enable Vault Update” is turned off, then Vault Tokens linked to Network Tokens will NOT be updated on Issuer Updates received from schemes.

**Note:* When PAN changes, merchants need to request new card details from customers and re-create the Vault token with Network Token under the hood*

Notifications

Merchants can configure Notifications for Network Tokenisation functionality covering TRID (Token Requestor ID) onboarding, Token Management, and Vault Update processes.

Supported Types of Notifications

- Email

- Sms

- Webhook

Supported Network Token Notifications:

- Vault Updated (Issuer Update): Notification is triggered when Vault (expiry year, expiry month, status) is updated based on Issuer Updates from schemes

- Network Token Registration Success: Notification is triggered when Visa or Mastercard Registration is moved to Completed status

- Network Token Registration Failure: Notification is triggered when Visa or Mastercard Registration is moved to Failed status

- Network Token Creation Failed Notification: Notification is triggered when Network Token provisioning fails after 3 Failover attempts or during On Fly flow

- Network Token Update (Issuer Update) Notification: Notification is triggered when Network Token (expiry year, expiry month, status) is updated based on Issuer Updates from schemes

The following Network Token related fields are available for merchants to select when configuring their notification templates

| Field | Description |

|---|---|

| token_id | Unique ID of the Network Token entity in the Paydock Database |

| token_service_id | Unique ID of the Network Token Service entity used to provision cryptogram for a charge |

| token_external_id | The external ID of the Network Token in Visa or Mastercard |

| token_reference | External token reference in Visa or Mastercard |

| token | External Network Token value |

| token_reference_id | Unique ID associated with a single token (Visa ONLY) |

More information on how to configure notifications in Paydock: Link

Permissions information

Feature toggles

Global and brands are able to disable/enable Network Tokens functionality for merchants:

- At the brand level, enable “Feature Options Allowed Registrations Network Token“ to enable Network Token registrations to be created, deleted, revoked and updated

- At the brand level, enable “Feature Options Allowed Services Network Token“ to enable Network Token services to be connected, deleted, updated

User permissions and access token permissions

| Function | Permission | Description | Linked API |

|---|---|---|---|

| Registration | registrations:create | Allows users to create Network Token registrations | POST /registrations |

| Registration | registrations:get | Allows users to to get registration details by Id | GET /registrations/{id} |

| Registration | registrations:search | Allows users to search all registrations created | GET /registrations |

| Registration | registrations:modify | Allows users to update registration | PUT /registrations/{id} |

| Registration | registrations:delete | Allows users to delete registration. Note, this only deletes from Paydock-side and will remain active on scheme side | DELETE /registrations/{id} |

| Registration | registrations:revoke | Allows users to revoke a registration, which will delete registration from both Paydock and scheme side. Note: This is only supported by Mastercard/SCOF (due to Visa-side limitation only). If this is operation is required for Visa/VTS, please contact support@paydock.com) | DELETE /registrations/{id}/revoke |

| Services | services:create | Allows users to connect Network Token service to the registration | POST /services |

| Services | services:modify | Allows users to update Network Token service | PUT /services/:id |

| Services | services:search | Allows users to search services created in Paydock | GET /services |

| Services | services:get | Allows users to get service by Id | GET /services/{id} |

| Services | services:delete | Allows users to delete Network Token service. Note: The Network Token service cannot be deleted if there is at least one active token created via this service. All network tokens should be deactivated first before deleting the service | DELETE /services/:id |

| Vaults | vault-tokens:create | Allows users to create Paydock Vault Tokens. Note: Network Tokens will be automatically created within the Paydock Vault Token when using the Vault API if all the following requirements are met: Merchant has active Network Token service connected for relevant scheme “default“ configured to “true“ for this service Registration connected to the service is in status “Completed“ If this is not true, the vault will be created without creating an underlying Network Token. | POST /v1/vault/payment_sources |

| Vaults | payment-sources-vault:get | Allows users to get details of a vault by vault_token ID. If a Network Token exists within this vault, its details will be returned | GET /v1/vault-tokens/{id} |

| Vaults | payment-sources-vault:search | Allows users to search all Vaults in their company account, if a Network Token exists within a given vault, its details will be returned | GET /v1/vault/payment_sources |

| Vaults | payment-sources-vault:delete | Allows users to delete Vault Token by vault_token_id. If a Network Token exists within this vault, it will also be deleted from Paydock | DELETE /v1/vault/payment_sources/{id} |

| Vaults/Network Token (available via Access token only as API based) | vault-network-tokens:create | Allows users to create a Network Token for underneath an existing Vault Token. Note: The following must be true for this to work: Merchant has active Network Token service connected for relevant scheme “default“ configured to “true“ Registration connected to the service is in status “Completed“ | POST /v1/vault/payment_sources/{id}/network-tokens/ |

| Vaults/Network Token (available via Access token only as API based) | vault-network-tokens:get | Allows merchants to get a Network Token by Network Token Id. | GET /v1/vault-tokens/{vault_token}/network-tokens/{id} |

| Vaults/Network Token (available via Access token only as API based) | vault-network-tokens:modify | Allows users to change “default“ network token for payments processing | PUT /v1/vault-tokens/{vault_token}/network-tokens/{id} |

| Vaults/Network Token (available via Access token only as API based) | vault-network-tokens:delete | Allows users to delete Network Token by Network Token ID. This will remove the Network Token from both Paydock + scheme side. The Paydock vault_token will not be deleted (only the Network Token will be removed) | DELETE /v1/vault-tokens/{vault_token}/network-tokens/{id} |

Reporting

Below are the fields available in the charges/transaction reporting:

| Field | Description | Type |

|---|---|---|

| token_id | Unique ID of the Network Token entity in the Paydock Database | ObjectID in MongoDB (ObjectId() ). maximum 24 characters |

| token_service_id | Unique ID of the Network Token Service entity used to provision cryptogram for charge | ObjectID in MongoDB (ObjectId() ). maximum 24 characters |

| token_external_id | External ID of the Network Token in VTS or SCOF | String. maximum 255 characters. Note: Format: Alphabetic, numeric, and hyphens ( - ), e.g. spaces are not allowed; |

| token_reference | External token reference in VTS or SCOF | String. maximum 64 characters. |

| token | External Network Token value | String. maximum 32 characters. |

| token_reference_id | Unique ID associated with a single token (Visa ONLY) | String. maximum 32 characters. |

| payment_account_reference | A non-financial reference assigned to each unique FPAN that's used to link the payment account of that PAN to affiliated payment tokens. | String. maximum 29 characters. |

MPGS Account Configuration

Merchants are encouraged to enable the “Bypass Check Card Details Do Not Change for Agreement” in their Master Merchant (MM) account. This is to ensure that API requests are not rejected where subsequent requests have either a different card or Network Tokens as their payment source compared to the original Cardholder Initiated Transaction (CIT).

The privilege allows account information to be changed throughout the series of recurring transactions on the same agreement.

![][image8]

Note - Merchant will need to check if this permission currently exists on their MPGS account. If not, then the merchant needs to raise an implementation project with MPGS to enable it on their MSO.

Implementation considerations

Backbook cutover

Token Migration will be introduced in later phases. For merchants who already have existing Vaults and want to bulk provision network tokens, Paydock will introduce a migration process, (potentially in Phase 3). The approach depends on how many Vaults need NT provisioning:

- If the number of tokens is not large: Bulk Network Token provisioning can be used for up to 100 Vaults per request.

- If the number of tokens is large: The recommendation is to wait for the migration solution in Phase 3.

Merchants can define their approach based on their specific needs and the volume of tokens requiring provisioning.

Token provisioning at checkout/Use of FPAN for initial transactions

Network Tokens are created under the hood of the Vault API which is used by merchants during the checkout process. The response time from the Visa/Mastercard service (when requesting a network token to be created) may take a few seconds to complete. Therefore, to avoid exposure of this latency to the cardholder during checkout flow, Network Token creation will be performed asynchronously. This means that the Network Token will be used in charge processing only if by the time the /charges endpoint is called, the Network Token has been successfully provisioned. If the Network Token is not yet created, then FPAN will be used instead.

This is as per best practice recommendation from the schemes.

EFTPOS merchant choice routing

If a Vault Token is used for merchant choice routing to EFTPOS, if the rules determine that EFTPOS gateway should be routed to, then FPAN will be used. If the rules determine that MPGS gateway should be routed to then Network Token will be used.

Standalone 3ds (Gpayments)

Standalone 3DS can be performed using:

- FPAN:

- Network Tokens

It’s recommended by schemes to use the same payment source for Standalone 3DS and for the following Charge. For example, if a 3DS check is performed using NT then a Charge should be also performed with Network Tokens for merchants to be granted a liability shift. However, if the issuer supports tokenisation and has the token mapped to the PAN the authorisation will be approved with liability shift even if payment sources for 3DS and Charge are different.

By default, Standalone 3DS will be performed using FPAN regardless if Vault has an active Network Token or not. The main reason is that not all gateways support Network Tokens and Paydock doesn’t know which Gateway merchant will use for Charge processing. If merchants want Standalone 3DS to be performed with Network Tokens there are the following options available.

Option 1: Integrate Analyse API

This option is recommended for merchants who enabled Routing Rules and have Standalone 3DS as part of their payment processing flow.

For Merchant flow will be the following:

- Call Analyse endpoint and pass required data

- Get Gateway ID from Analyse response and call standalone 3DS API passing Gateway ID

- Call Charges API with attached standalone 3ds without Gateway ID

Paydock will complete the following checks using the passed Gateway ID to define if 3DS can be completed with NT:

- If the Vault token has an active Network Token, NT Registration status is "Completed," and gateway_id supports NT, then 3DS will be completed with NT otherwise with FPAN.

Refer to the Analyse Endpoint Integration Guide for more context.

Option 2: Specify Gateway ID

This option is recommended for merchants who don’t have Routing Rules enabled as part of their payment processing flow.

Merchants have to Include gateway_id in the standalone 3DS request. Paydock will complete the following checks using the passed Gateway ID to define if 3DS can be completed with NT:

- If the Vault token has an active Network Token, NT Registration status is "Completed," and gateway_id supports NT, then 3DS will be completed with NT.

Note: When attaching a standalone 3DS to create a charge, use the same gateway_id as for the standalone 3DS endpoint.

Important: If raw card details are used for standalone 3DS (because NT has not yet been provisioned), NT will be utilised for financial charges if the gateway supports it and NT is already provisioned.

API Reference

The PayDock API is organized around REST. Our API has predictable, resource-oriented URLs, and uses HTTP response codes to indicate API errors. We use built-in HTTP features, like HTTP authentication and HTTP verbs, which are understood by off-the-shelf HTTP clients. JSON is returned by all API responses, including errors.

To make the API as explorable as possible, accounts have test mode and live mode API keys. There is no "switch" for changing between modes, just use the appropriate URL to perform a live or test transaction. Requests made with test mode credentials never hit the banking networks and incur no cost.

PayDock users can interact with the service in a number of ways.

Visit PayDock Postman documentation page:

Or visit PayDock Master Merchant (Brand) documentation:

Development SDKs

PayDock provides SDKs or libaries for different programming languages to make integration as simple as possible.

Client side

Client SDK

The Client SDK is our recommended solution for collecting payment details on your website.

The Client SDK is also available through npm.

More detailed documentation on classes and methods available through npm - reference by class.

Client-sdk

It is a solution for collecting and handling payment sources in secure way.

With SDK you can create a payment form widget as an independent part or insert use inside your form.

The SDK supports methods for customization of widget by your needs (styling, form fields, etc)

Other information

To work with the widget you will need public_key or access_token (see Authentication)

Also you will need added gateway (see API Reference by gateway)

Get started

The Client SDK ships in JavaScript ES6 (EcmaScript 2015) in three different formats (CJS, ESM and UMD) along with respective TypeScript declarations. Below, we exemplify how to import each format.

Download from CDN

<script src="https://widget.paydock.com/sdk/latest/widget.umd.min.js"></script>

<script>

var widget = new paydock.HtmlWidget('#tag', 'publicKey', 'gatewayId');

</script>

For browser environments, you can import the Client SDK directly from our CDN to

your project's HTML. To accomplish this, include the Client SDK in your page

using one and only of the two script tags below. After this step you will be

able to access the Client SDK features via the global variable paydock.

For production we recommend using the compressed version (.min.js) since

it will result in faster loading times for your end users.

Compressed version for production:

https://widget.paydock.com/sdk/latest/widget.umd.min.jsFull version for development and debug:

https://widget.paydock.com/sdk/latest/widget.umd.js

You may download the production version of the Client SDK scripts here, and, the development version here.

For more advanced use-cases, the library has UMD format that can be used in RequireJS, Webpack, etc.

With package manager

// module import - CommonJS/Node projects ✅

const paydock = require('@paydock/client-sdk')

const api = new paydock.Api('publicKey');

// named import - ESM projects or TypeScript projects ✅

import { HtmlWidget } from '@paydock/client-sdk'

const widget = new HtmlWidget('#selector', 'publicKey', 'gatewayId');

// namespaced import - ESM projects or TypeScript projects ✅

import * as Paydock from '@paydock/client-sdk'

const widget = new Paydock.HtmlWidget('#selector', 'publicKey', 'gatewayId');

// default import - Not officially supported . They are handled differently by different tools / settings!

❌

import paydock from '@paydock/client-sdk'

>>> "Uncaught SyntaxError: The requested module does not provide an export named 'default'"

Our NPM package is compatible with all package managers (e.g., npm, yarn,

pnpm, bun). Using npm the following command would add the Client SDK as a

production dependency.

npm install @paydock/client-sdk

After installation is complete, if you are developing in NodeJS environments or

using tools that expect your JavaScript code to be in CJS format (e.g., Jest,

Karma, RequireJS, Webpack), you can import the Client SDK using CommonJS modules.

For these environments the UMD format (@paydock/client-sdk/bundles/widget.umd.js)

can also be used as a fallback. Alternatively, in case you are developing in

projects that have access to modern bundlers such as Vite or others (e.g., SPA

libs or SSR Metaframeworks), you can import the Client SDK features using ESM

through named imports or namespaced imports.

Widget

You can find description of all methods and parameters here

A payment form where it is possible to enter card data/bank accounts and then receive a one-time token for charges, subscriptions etc. This form can be customized, you can customize the fields and set styles. It is possible in real-time to monitor the actions of user with widget and get information about payment-source using events.

Widget simple example

Container

<div id="widget"></div>

You must create a container for the widget. Inside this tag, the widget will be initialized

Initialization

Then write only need 2 lines of code in js to initialize widget

Full example

<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="UTF-8">

<title>Title</title>

<style>iframe {border: 0;width: 100%;height: 300px;}</style>

</head>

<body>

<form id="paymentForm">

<div id="widget"></div>

<input name="payment_source_token" id="payment_source_token" type="hidden">

</form>

<script src="https://widget.paydock.com/sdk/latest/widget.umd.min.js" ></script>

<script>

var widget = new paydock.HtmlWidget('#widget', 'publicKey');

widget.onFinishInsert('input[name="payment_source_token"]', 'payment_source');

widget.load();

</script>

</body>

</html>

Widget advanced example

Customization

This example shows how you can customize to your needs and design

Customization from html

<div id="widget"

widget-style="text-color: #FFFFAA; border-color: #yellow"

title="Payment form"

finish-text="Payment resource was successfully accepted"></div>

This example shows how you can set style and texts from html

Settings

This example shows how you can use a lot of other methods to settings your form

Error handling

Overview

Error events are emitted when an error occurs during widget operations. These events provide detailed information about the error, including its category, cause, and contextual details.

Error Event Structure

Base Properties

| Property | Type | Description |

|---|---|---|

event |

string |

Always set to "error" |

purpose |

string |

Indicates the purpose of the action that triggered the error event (e.g., "payment_source") |

message_source |

string |

Source of the message (e.g., "widget.paydock") |

ref_id |

string |

Reference ID for the operation |

widget_id |

string |

Unique identifier of the widget instance |

error |

object |

Error object containing error information |

Error Object Properties

The error object contains detailed information about the error:

| Property | Type | Description |

|---|---|---|

category |

string |

High-level error classification |

cause |

string |

Specific error cause |

retryable |

boolean |

Indicates if the operation can be retried |

details |

object |

Additional error context |

Error Categories

| Category | Description |

|---|---|

configuration |

Configuration-related errors |

identity_access_management |

Authentication and authorization errors |

internal |

Internal system errors |

process |

Process and operation errors |

resource |

Resource-related errors |

validation |

Input validation errors |

Error Causes

| Cause | Category | Description |

|---|---|---|

aborted |

process |

Operation was aborted |

access_forbidden |

identity |

Access to resource is forbidden |

already_exists |

validation |

Resource already exists |

canceled |

process |

Operation was canceled |

invalid_configuration |

configuration |

Invalid widget configuration |

invalid_input |

validation |

Invalid input provided |

not_found |

resource |

Requested resource not found |

not_implemented |

process |

Requested feature not implemented |

rate_limited |

process |

Too many requests |

server_busy |

process |

Server is too busy to handle request |

service_unreachable |

process |

Unable to reach required service |

unauthorized |

identity |

Authentication required |

unknown_error |

internal |

Unexpected error occurred |

unprocessable_entity |

validation |

Valid input but cannot be processed |

Error Details Object

| Property | Type | Description |

|---|---|---|

cause |

string |

Matches the top-level error cause |

contextId |

string |

Context identifier (usually matches widget_id) |

message |

string |

Human-readable error message |

timestamp |

string |

ISO 8601 timestamp of when the error occurred |

Example

Handling Errors (Tips)

When handling errors, consider:

- Check the

retryableflag to determine if the operation can be retried - Use the

categoryfor high-level error handling logic - Use the

causefor specific error handling cases - The

contextIdcan be used for error tracking and debugging - The

timestamphelps with error logging and debugging

Full example

<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="UTF-8">

<title>Title</title>

<style>iframe {border: 0;width: 100%;height: 400px;}</style>

</head>

<body>

<form id="paymentForm">

<div id="widget"

widget-style="text-color: #FFFFAA; border-color: #yellow"

title="Payment form"

finish-text="Payment resource was successfully accepted">

</div>

<div

id="error"

style="

display: none;

max-width: 600px;

margin: 16px auto;

padding: 16px 20px;

border-radius: 8px;

background-color: #FEF2F2;

border: 1px solid #FEE2E2;

box-shadow: 0 1px 3px rgba(0, 0, 0, 0.1);

font-family: system-ui, -apple-system, sans-serif;

color: #991B1B;

line-height: 1.5;

font-size: 14px;

"

title="error"

>

<div style="display: flex; align-items: flex-start; gap: 12px;">

<div>

<h4 style="margin: 0 0 4px 0; font-size: 14px; font-weight: 600;">Access Error</h4>

<div id="error-message"></div>

</div>

</div>

</div>

</form>

<script src="https://widget.paydock.com/sdk/latest/widget.umd.js" ></script>

<script>

var widget = new paydock.HtmlWidget('#widget', 'publicKey', 'gatewayId');

widget.setSupportedCardIcons(['mastercard', 'visa']);

widget.setFormFields(['phone', 'email']);

widget.setRefId('custom-ref-id');

widget.onFinishInsert('input[name="payment_source_token"]', 'payment_source');

widget.on('error', ({ error }) => {

document.getElementById('error-message').textContent = error.details.message;

document.getElementById('error').style.display = 'block';

});

widget.load();

</script>

</body>

</html>

Payment sources widget

You can find description of all methods and parameters here

This widget provides a list of previously added (saved) payment-sources by customer_id or reference. The widget provides an opportunity to use events to track the process of selecting payment-sources and provide meta information about the payment-sources.

Payment-source requires a query_token that represents a pre-generated and secure token for limiting the list payment-sources, for a specific user or reference.

In order to generate this token, you need to send a GET request to getCustomerList where required query parameter must be id or reference. In response you get response.query_token which you can use in the widget.

Payment sources simple example

Container

<div id="list"></div>

You must create a container for the widget. Inside this tag, the widget will be initialized

Initialization

Then write only need 2 lines of code in js to initialize widget

Full example

<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="UTF-8">

<title>Title</title>

<style>iframe {border: 0;width: 40%;height: 300px;}</style>

</head>

<body>

<div id="list"></div>

<script src="https://widget.paydock.com/sdk/latest/widget.umd.min.js" ></script>

<script>

var list = new paydock.HtmlPaymentSourceWidget('#list', 'publicKey', 'queryToken');

list.load();

</script>

</body>

</html>

Payment sources advanced example

Customization

This example shows how you can customize to your needs and design

Settings

This example shows how you can use a lot of other methods to settings your form

Full example

<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="UTF-8">

<title>Title</title>

<style>iframe {border: 0;width: 40%;height: 300px;}</style>

</head>

<body>

<div id="list"></div>

<input type="text" name="ps_id" />